Menu

Menu

Shared Value • Shared Prosperity

03

Chairman's

Message

In the name of Allah, Most Gracious and Most Merciful

On behalf of Management Committee, I am honoured to present the Malaysian Takaful Association’s (MTA) Annual Report for 2022.

Despite the pandemic’s impact on the Takaful industry and other economic and financial sectors, we are pleased to share that the industry has persevered, and has continued to grow and contribute to the economic development of the nation. Evidence of this, among others, is the shift in people’s attitudes towards financial protection, especially Takaful. The industry has witnessed a marked increase among individuals and businesses recognising the importance of having in place adequate protection to safeguard their health and finances. MTA sees this as a positive response and welcome development towards our ongoing efforts to raise awareness of Takaful over the last few years, efforts which intensified during the peak of pandemic in 2020-2021 and continued into 2022. MTA is delighted to see our efforts bearing fruit and making a difference to the rates of financial literacy and awareness of financial protection amongst the Malaysian population. Alhamdulillah.

05

Development

of the Takaful

Industry 2022

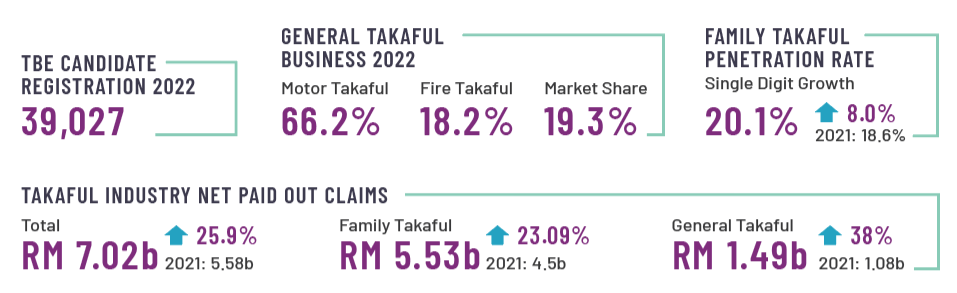

In 2022, MTA celebrated its twentieth year supporting the growth and development of the industry. Despite the challenges of the pandemic, the Association’s industry leadership remains strong. Overall, the Malaysian Takaful industry showed positive performance for 2022 despite the country still being in the pandemic recovery phase. Conscious efforts and strategic collaborations to promote awareness of takaful to the younger generation via social media and to make takaful more affordable and digitally accessible to different segments of society over the last two years have positively impacted the industry’s growth.

Value-Based Intermediation for Takaful (VBIT): An Industry Defined By Values

Emulating the country’s Value-Based Intermediation (VBI) approach introduced by Bank Negara Malaysia in 2017, the VBIT Framework was launched in June 2021 after an extensive industry consultation and collaboration spearheaded by MTA, its 18 member Takaful and Retakaful companies and industry stakeholders. In a nutshell, VBIT inspires the Takaful industry’s journey to optimally play its role in offering livelihood and financial assurance and relevant value-based solutions to all members of the community.

VBIT inspires the journey towards a sound and stable financial sector that promotes economic growth, enables financial intermediation, and facilitates the flow of funds between parties, thus ensuring efficient allocation of financial resources towards promoting economic growth and development. The journey also acknowledges industry enablers who push and facilitate the industry towards embracing innovation and digitalization with the aim to ensure efficient, effective, available and accessible financial services and financial education.

Acknowledging that a framework in its essence an ideal conceptual document, the real measure of impact and success for any financial industry or system is its ability to address the socio-economic issues of a community or country while staying true to its business objectives. It should also provide value-creation to stakeholders, beyond simply making profits. The MTA subsequently complemented the framework with the launch of a VBIT Roadmap in October 2022, which envisions the strengthened role of the Takaful industry as part of the nation’s economy as a solutions provider for Malaysians seeking to achieve financial assurance and build their resilience against undesired events.

The VBIT Roadmap aligns the framework with BNM’s Financial Sector Blueprint 2022-2026 (launched after the VBIT). For the stakeholder, the VBIT Framework and Roadmap provide a new way for them to reposition Takaful, while upholding the objectives of Shariah. To ensure its universal application, VBIT is also benchmarked against, and is in alignment with, globally accepted sustainability concepts including the United Nations Sustainable Development Goals (UNSDGs) and UNEP Finance Initiative Principles for Sustainable Insurance (PSI).