Menu

Menu

05

Development of the Takaful Industry 2022

In 2022, MTA celebrated its twentieth year supporting the growth and development of the industry. Despite the challenges of the pandemic, the Association’s industry leadership remains strong. Overall, the Malaysian Takaful industry showed positive performance for 2022 despite the country still being in the pandemic recovery phase. Conscious efforts and strategic collaborations to promote awareness of takaful to the younger generation via social media and to make takaful more affordable and digitally accessible to different segments of society over the last two years have positively impacted the industry’s growth.

Value-Based Intermediation for Takaful (VBIT): An Industry Defined By Values

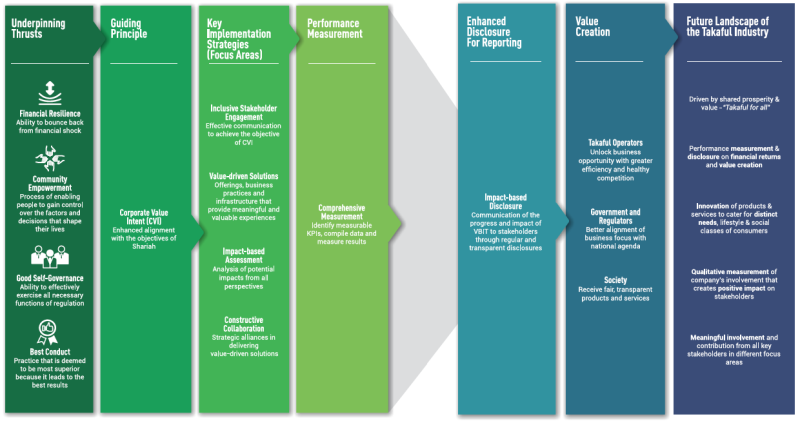

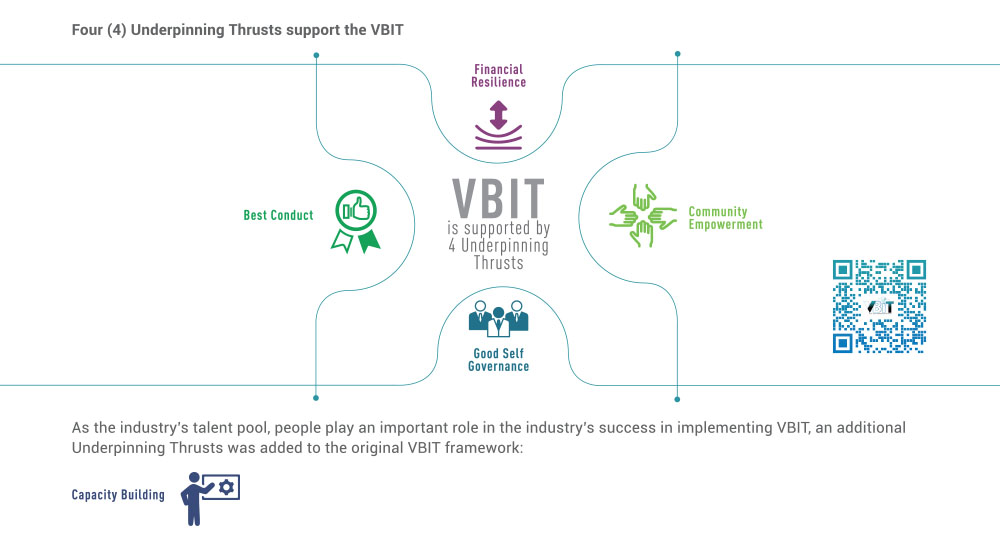

Emulating the country’s Value-Based Intermediation (VBI) approach introduced by Bank Negara Malaysia in 2017, the VBIT Framework was launched in June 2021 after an extensive industry consultation and collaboration spearheaded by MTA, its 18 member Takaful and Retakaful companies and industry stakeholders. In a nutshell, VBIT inspires the Takaful industry’s journey to optimally play its role in offering livelihood and financial assurance and relevant value-based solutions to all members of the community.

VBIT inspires the journey towards a sound and stable financial sector that promotes economic growth, enables financial intermediation, and facilitates the flow of funds between parties, thus ensuring efficient allocation of financial resources towards promoting economic growth and development. The journey also acknowledges industry enablers who push and facilitate the industry towards embracing innovation and digitalization with the aim to ensure efficient, effective, available and accessible financial services and financial education.

Acknowledging that a framework in its essence an ideal conceptual document, the real measure of impact and success for any financial industry or system is its ability to address the socio-economic issues of a community or country while staying true to its business objectives. It should also provide value-creation to stakeholders, beyond simply making profits. The MTA subsequently complemented the framework with the launch of a VBIT Roadmap in October 2022, which envisions the strengthened role of the Takaful industry as part of the nation’s economy as a solutions provider for Malaysians seeking to achieve financial assurance and build their resilience against undesired events.

The VBIT Roadmap aligns the framework with BNM’s Financial Sector Blueprint 2022-2026 (launched after the VBIT). For the stakeholder, the VBIT Framework and Roadmap provide a new way for them to reposition Takaful, while upholding the objectives of Shariah. To ensure its universal application, VBIT is also benchmarked against, and is in alignment with, globally accepted sustainability concepts including the United Nations Sustainable Development Goals (UNSDGs) and UNEP Finance Initiative Principles for Sustainable Insurance (PSI).

Implementation and Measuring Success

Illustration 1: The comprehensive VBIT Framework solidifies Malaysia’s position as a forward-looking leader in the global takaful market

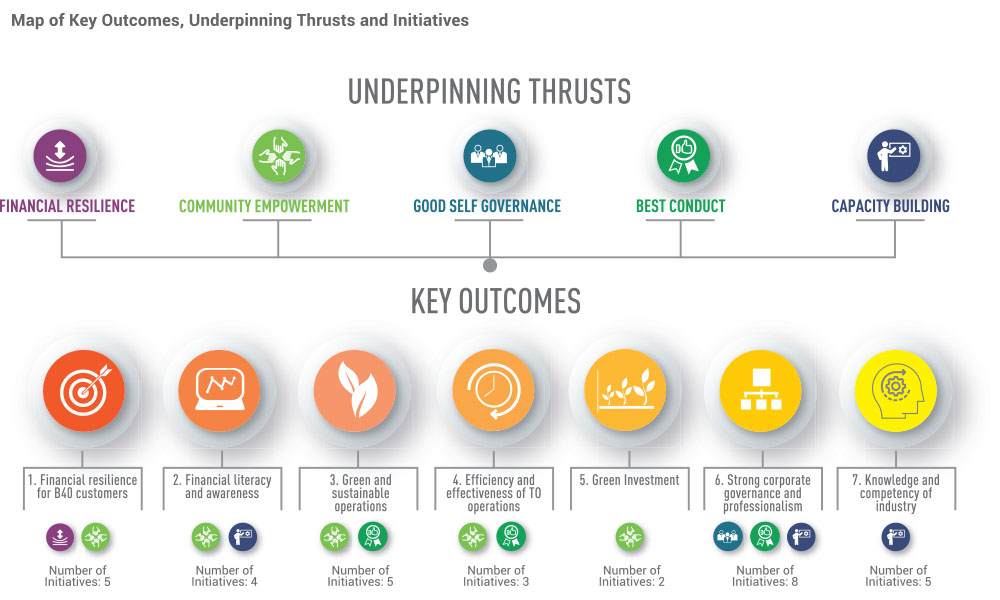

Many roadmaps have been developed by countries and industries with varying degrees of success in implementation. Two critical success factors in VBIT are the call for proper project Governance Structure and the ability to objectively assess its achievements. As the Malaysian Takaful players start to look at implementing VBIT into their business practices, feedback on the challenge of identifying measures and key performance indicators led the MTA to its most recent initiative to support the VBIT – the launch of a research collaboration to develop a Maqasid-based VBIT Scorecard.

Governance Structure

An FSB Steering Committee was established at the Takaful industry level to address and align the VBIT initiatives with the wider scope of BNM’s FSB26; and to provide the necessary industry oversight. This committee is also mandated to identify obstacles and opportunities that may halt or spur the industry’s progress, and act as a reference and collaborative platform between stakeholders, BNM, government agencies and private institutions.

Assessing Progress

The VBIT introduces initiatives and measures for implementation industry-wide and at takaful-operator levels. Key performance indicators and project management scorecards solidifies these initiatives, along with a ready-for-use review exercise tool known as the VBIT Maturity Continuum, allowing stakeholders to conduct self-assessments to monitor their incremental progress towards the VBIT goals. To further strengthen the spiritual side of VBIT implementation, work on a landmark study and development of a Maqasid-based VBIT Scorecard has commenced and is expected to be unveiled in 2023.

Illustration 2: Mapping of Key Outcomes, Underpinning Thrusts and corresponding number of initiatives identified in the VBIT Roadmap to be implemented and self-assessed at industry and takaful-operator levels

Maqasid al-Shariah Based VBIT Scorecard

The MTA, in November 2022, launched a landmark collaboration with INCEIF University, through its research arm ISRA Research Management Centre, to conduct the research to develop a Maqasid al-Shariah Based Scorecard (MSS) for VBIT. The MSS is envisioned to have workable and measurable performance indicators, taking into consideration the industry’s pain points. These indicators, when launched, would be the first of its kind developed for the industry and allow the industry to chart the progress and impact of the industry’s growth and development and link these impacts to the objectives of the Maqasid al- Shariah.

Financial Sector Blueprint 2022-2026 (FSB26)

In the words of Malaysia’s then Minister of Finance (in January 2022), “Malaysia is at an inflection point. As we exit and recover from the COVID-19 pandemic, it is hard to look back and ignore the scars it has left on the lives and livelihoods of many. Yet, it is important for us to look forward and not lose sight as to what is ahead of us, as we continue to push forward towards becoming a high value-added, high-income nation. The pandemic has accelerated the digital revolution, which has profoundly changed the way we work, play and interact with each other. Meanwhile, the implications of climate change, biodiversity loss, and demographic change are no longer academic, but real and pressing. While these shifts pose new risks – especially to the most vulnerable in our society – they also present opportunities to build back better and transform the country’s development trajectory.”

The FSB26 acknowledges the financial sector’s role in realising the nation’s socio-economic aspirations. The strategies identified in FSB26 are critical to help the financial sector to navigate the oncoming challenges and capture new opportunities towards, among other things, supporting families to grow and protect their wealth, or helping businesses venture into new territories.

Direct Distribution Channel for Pure Protection Products Under Life Framework

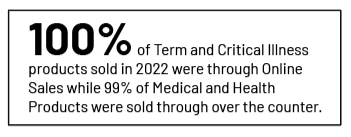

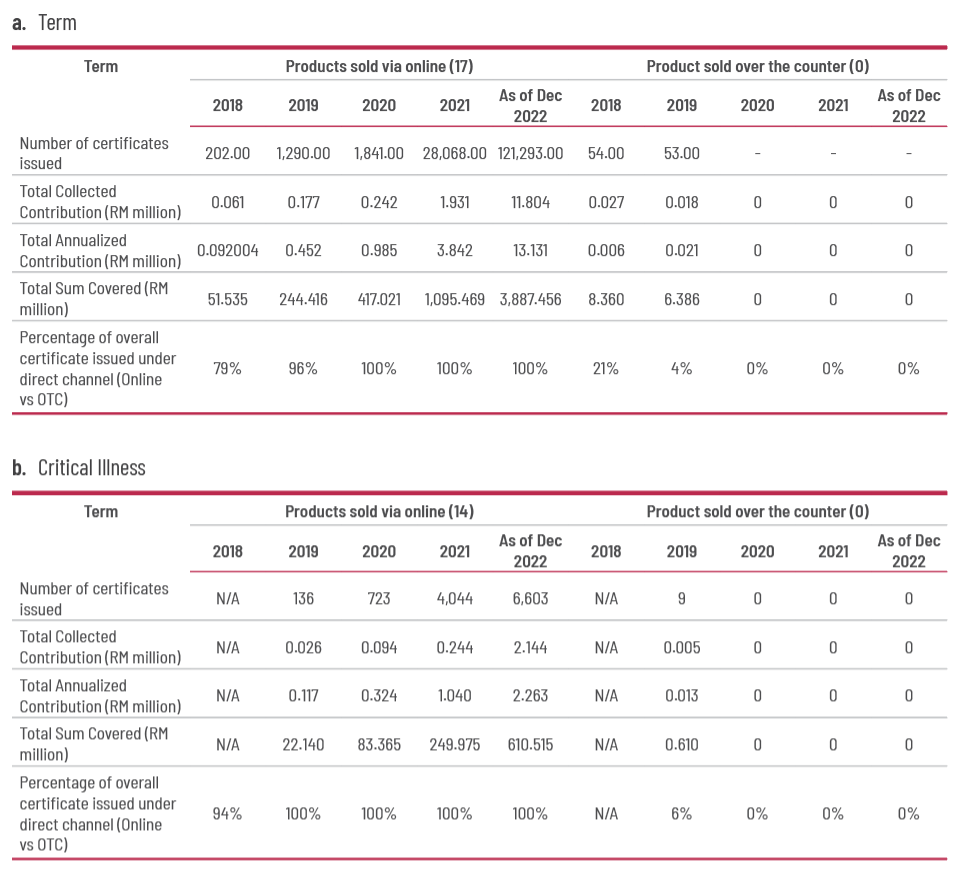

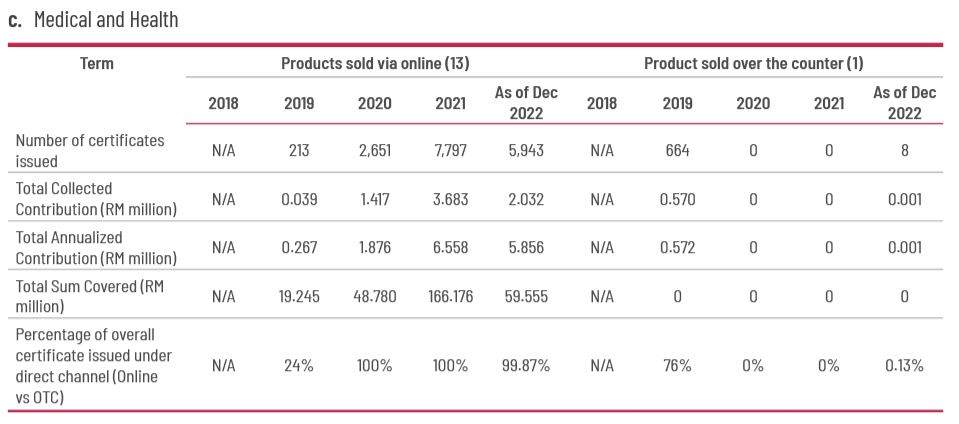

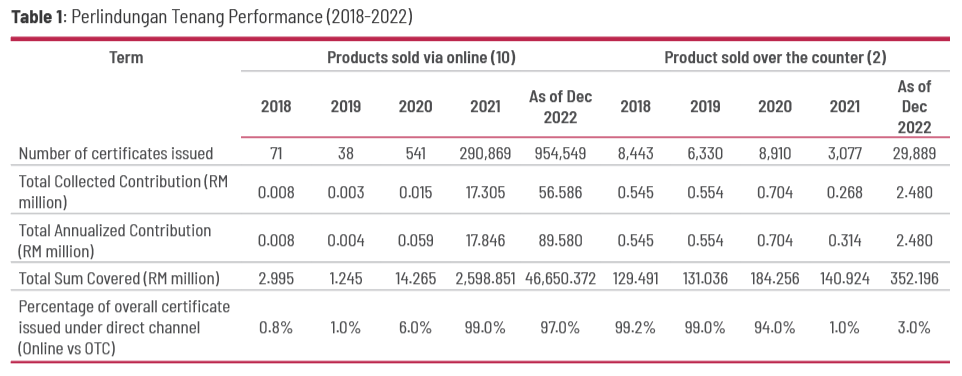

Since the introduction of the Policy Document on Direct Distribution Channels for Pure Protection Products in September 2018, the industry players have introduced 17 term products, 14 critical illness products, and 14 medical and health products to the market. These products are accessible online and by walk-in at the branches of Takaful Operators nationwide.

For the year 2022, the industry issued 133,839 new certificates amounting to a total sum covered of over RM4.5 billion. Putting this into context, this is a huge and significant increment of 335% from the 39,909 new certificates issued in 2021.

Term plan leads as the major contributor to the market performance followed by medical and health products and critical illness products. Looking at the stark increase, it can be inferred that the COVID-19 pandemic has strongly boosted public awareness of the importance of life, critical illness, as well as medical and health coverage.

Policy Document on MFRS17 Financial Reporting

BNM has published the Financial Reporting for Takaful Operators Policy Document and Financial Reporting Policy Document on 29 April 2022, which set out the revised requirements applicable for takaful operators and insurers to ensure alignment with the Malaysian Financial Reporting Standards (MFRS) 17 Insurance contracts and the MFRS 9 Financial Instruments requirements.

The implementation of Malaysian Financial Reporting Standards 17 (MFRS17) has been extended to 1 January 2023. Prior to the official implementation, MTA has been actively engaged with our consultant to assist member companies in preparing for the new reporting standard in 2023. Our consultant has been engaging with our members in terms of i.e., having forums and survey to gauge our members’ latest readiness for the implementation. The taxation issues addressed have been taken note by our consultant and they have been responding and providing resolutions to the taxation issues related to the standard.

Specifically for takaful operators, the disclosure requirements have been strengthened to reflect specificities of takaful. Requirements have also been aligned with recommendations by the Malaysian Accounting Standards Board (MASB) and latest ruling by the Shariah Advisory Council relating to application of MFRS 17 to takaful businesses (i.e. columnar presentation of financial statements and qard measurement).

Policy Document on BancaTakaful / BancaAssurance

Bank Negara Malaysia has issued a policy document on 30 June 2022 for Bancassurance / Bancatakaful. The policy document sets out the policy requirements and guidance for bancassurance / bancatakaful arrangements, which aim to enhance the bancassurance / bancatakaful as an effective channel and further strengthen safeguards in place to ensure the delivery of better consumer outcomes. The requirements are now extended to bancassurance / bancatakaful partners, where relevant. This policy’s requirements will also apply to existing and new bancassurance / bancatakaful arrangements, including renewal of bancassurance / bancatakaful agreements unless otherwise specified.

Exposure Draft on Licensing and Regulatory Framework for Digital Insurers and Takaful Operators (DITOs)

Bank Negara Malaysia (BNM) today issued the Exposure Draft on Licensing and Regulatory Framework for DITOs for written feedback following the issuance of the Discussion Paper earlier this year.

The Exposure Draft outlines the proposed framework to facilitate the entry of DITOs in Malaysia that can offer strong value propositions to realise the following outcomes:

Inclusion – Enhanced financial resilience of consumers whose protection needs are currently not served or not adequately served;

Competition – Innovative products to cater to diverse protection needs; and

Efficiency – Convenient and seamless consumer experience with greater cost savings.

DITOs are envisaged to carry out insurance or takaful business entirely (or almost entirely) through digital or electronic means. This, in turn, is expected to drive new types of business and operating models to meet diverse consumer needs through wider product choices and more efficient service quality. However, in advancing these innovations, BNM continues to preserve a strong focus on sound risk management and consumer protection.

Discussion Paper on Climate Risk Stress Testing Exercise

This discussion paper sets out Bank Negara Malaysia’s (“the Bank”) proposed framework and elements for the industry-wide climate risk stress testing (CRST) exercise in 2024. The paper puts forward for discussion the applicability and format of the exercise, and technical elements such as scenarios selection, portfolio scope and granularity and other considerations.

Exposure Draft on Professionalism of Insurance and Takaful Agents

BNM issued an Exposure Draft on Professionalism of Insurance and Takaful Agents (ED) on 27 April 2022. The ED sets out proposed requirements that licensed insurers and licensed takaful operators (ITOs) shall comply with in relation to the recruitment of their agents, including the agents’ minimum qualifications, fit and proper criteria, and due diligence process, as well as requirements on the treatment of errant agents and training. Furthermore, the requirements in the policy document are intended to require licensed insurers and takaful operators (ITOs) to ensure that their agents are competent, qualified, and act professionally in the best interest of customers at all times. Also, to improve public confidence in the integrity of ITOs’ agency workforce as a trusted and reliable channel for the distribution of insurance and takaful products. The policy document is scheduled to be released within the first half of 2023.

Exposure Draft on Operating Cost Controls for General Insurance and Takaful Business

BNM issued an Exposure Draft on Professionalism of Insurance and Takaful Agents (ED) on 15 July 2022. The ED sets out Bank Negara Malaysia’s (the Bank) proposed revision to the requirements on licensed general insurers’ and licensed general takaful operators’ payment of commissions and related expenses to intermediaries, as well as management expenses. In brief, the policy document sets out the realignment of operating cost control categories and limits. Secondly, the requirements and expectations on a licensed person’s policies on remuneration, governance, and management of intermediaries, and lastly, the reporting requirements. Moreover, the requirements in the policy document are intended to strengthen licensed persons’ financial discipline and accountability on the management of their intermediaries. This is aimed at promoting the better conduct of intermediaries and preserving the good value of products and services offered to financial consumers. Secondly, to accord licensed persons greater flexibility to manage operating costs that are commensurate with their business strategies. This would pave the way for greater innovation and promote greater access for unserved and underserved financial consumer segments. Lastly, to enhance clarity on the cost control requirements, in particular on the applicability and cost classification. The policy document is scheduled to be released within the first half of 2023.

TAX ISSUES

Tax Issues Affecting the Industry

In 2022, Ministry of Finance (MOF) had responded to the industry proposal submission related to the ReTakaful/ Reinsurance Discount and Experience Refund which are not taxable and the issue would not be raised again by IRB. In addition, MOF had granted the industry’s appeal on the exemption of single-tier dividend up to year of assessment 2022. However, with effect from year of assessment 2022, the exemption would be withdrawn. The industry (MTA and LIAM) had appointed PricewaterhouseCoopers (PwC) to assist on the submission to Inland Revenue Board (IRB) and the Ministry of Finance (MOF) related to the matters.

Budget 2022

In the Budget 2022 announcement and Finance Bill 2021, the tax proposals:

1. Cukai Makmur

2. Section 107D – Withholding Tax (WHT) on payments made to agent, dealer or distributor have been introduced which have an impact on the insurance and takaful industry.

Given the uncertainties surrounding the implementation of the proposals and operational issues that could arise, the industry (MTA, LIAM and PIAM) has jointly appointed PricewaterhouseCoopers (PwC) and submitted a proposal to the Inland Revenue Board (IRB) sought an extension remittance of WHT and clarification on operational issues in relation to the remittance of WHT and Cukai Makmur. The IRB provided its replies and the tissues the industry was resolved.

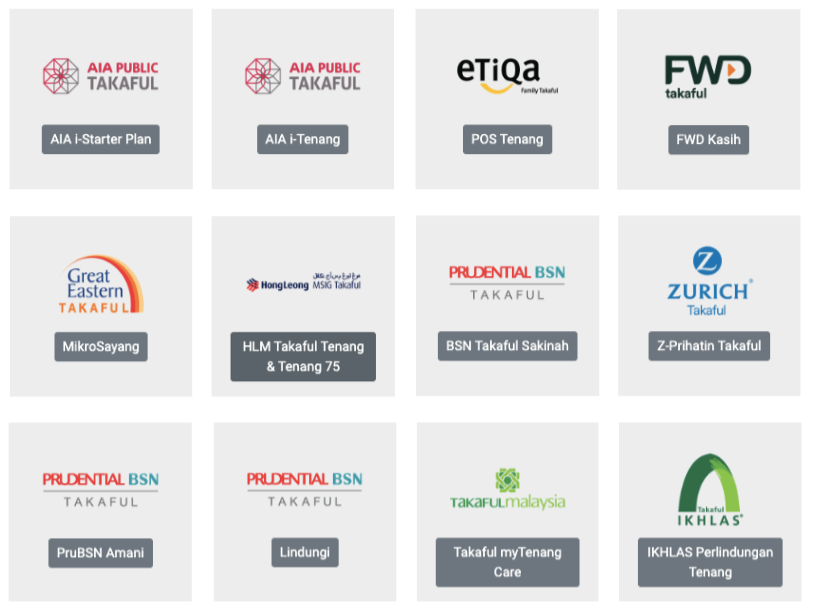

PERLINDUNGAN TENANG

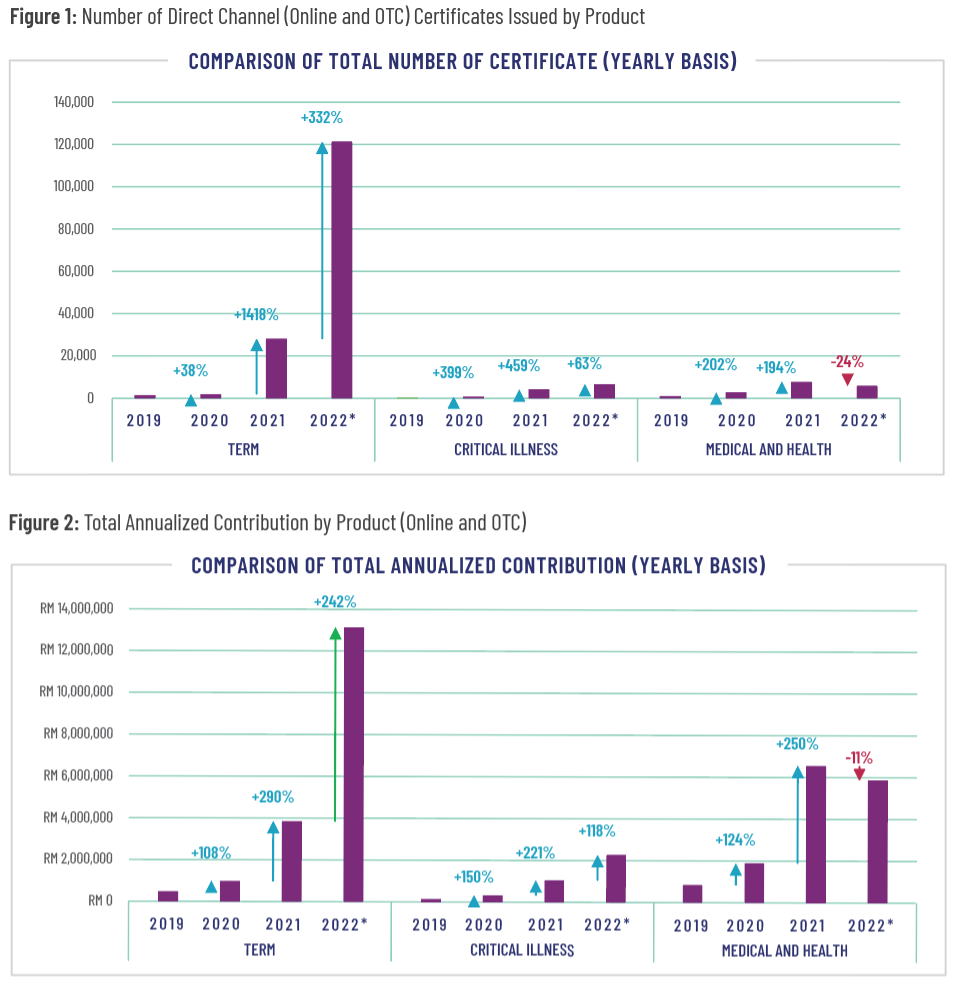

In 2022, there were 12 products offering Takaful protection available under Perlindungan Tenang umbrella, with more products being developed to cater to the various needs of the Malaysian public. Figures indicate that there is wider acceptance of Perlindungan Tenang products by the Malaysian market, as they can get Perlindungan Tenang cover for as low as RM 2.09 a month for a sum cover as low as RM10,000. In October 2022 alone, over 840,000 new certificates were issued with a total sum cover worth over RM42 billion. MTA welcomes this positive trend, as it shows a significant increase of 3 times the number of certificates issued, and 21 times more than the sum covered than the year 2021.

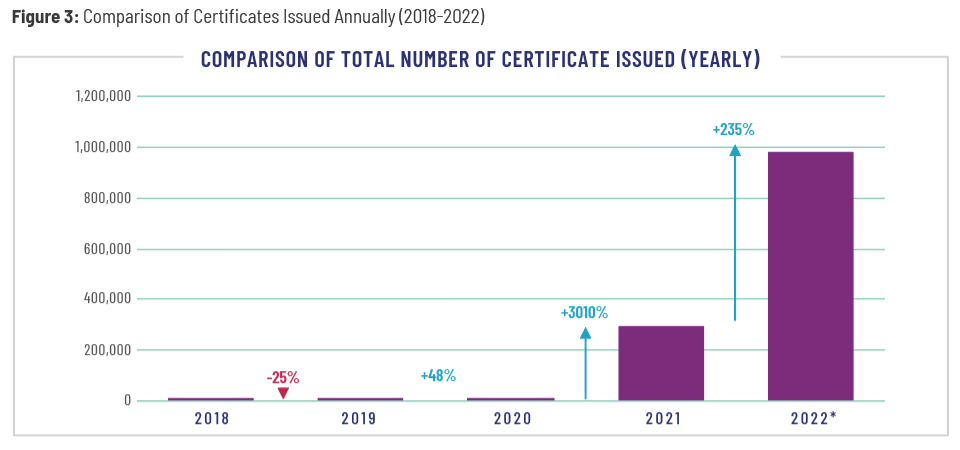

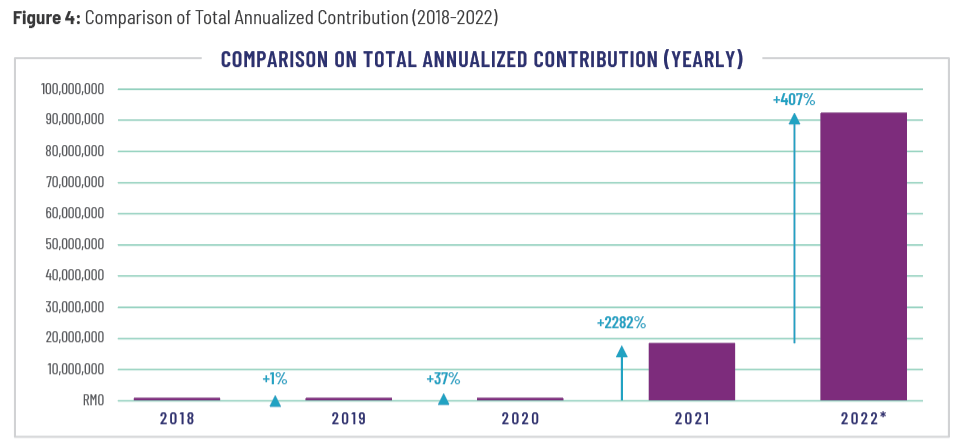

Table 1 shows the positive performance of Perlindungan Tenang products for the years 2018 to 2022.

Total Number of Perlindungan Tenang Certificates Issued (Online and OTC) are shown in Figures 3.

A comparison of Perlindungan Tenang Total Annualized Contribution (Online and OTC) are shown in Figures 4 .

Illustration 3: List of Products offered in Perlindungan Tenang

Perlindungan Tenang Voucher Programme

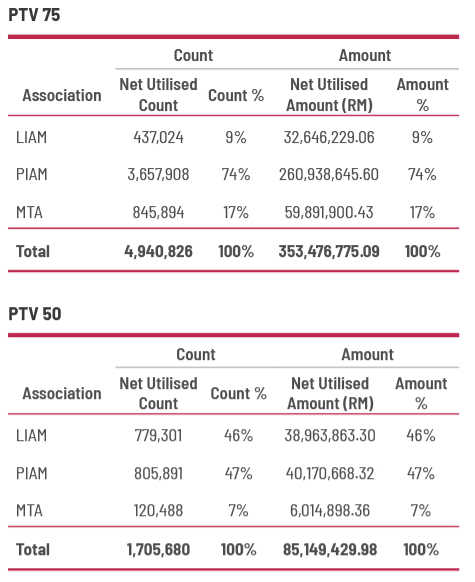

Acknowledging the positive impact created by the Perlindungan Tenang initiative on the social protection of Malaysians, the government, in its Budget 2022, announced the extension of the Perlindungan Tenang Voucher Programme for a second year (in 2022). Compared to the RM50 voucher in 2021, the voucher amount in 2022 was increased to RM75. The budget also allowed the PTV recipients (those eligible were recipients of the Bantuan Prihatin Rakyat programme) to use the voucher to purchase comprehensive insurance policies for motorcycles below 150 cc. Following the announcement of the extension, a more comprehensive communication campaign was needed tell the Malaysian public about the PTV programme and its benefits. MTA was an instrumental player in this campaign, which included the launch of a new PTV video, multiple joint press releases by MTA and the industry associations, as well as KOL engagements.

Table 2: PTV RM50 & RM75 Utilization for 2022 as at 31 December 2022

RESEARCH AND STUDIES

Customer Satisfaction Survey 2022/2023

As part of the ongoing efforts by BNM to ensure that all insurance and Takaful industry players continue to deliver their commitment and service deliveries as stated in their customer service charters (CSCs), the central bank in collaboration with the insurance and Takaful industry associations (LIAM, MTA and PIAM) appointed NielsenIQ Malaysia to conduct a customer satisfaction survey.

The survey is an important step towards ensuring the industry meets the customer service standards outlined in the respective company’s CSCs, and to drive improvement on the delivery of overall customer experience by all insurance and Takaful industry players.

Study on Potential Achievers

MTA has engaged with Inspire Group Asia (IGA) to conduct a study on performance of underperforming Takaful agents. This initiative is conducted in phases:

• Phase 1 – Online survey

A survey regarding factors of underperformance was developed by IGA and disseminated by Takaful Operators to underperforming agents on 22 September 2022.

• Phase 2 – Focus group

5 sessions of focus group were conducted with various stakeholders for a more in-depth study. The dates and attendees of the sessions are as follows:

• Phase 3 of the initiative is a final report for the findings which been developed by IGA.

Study on Emerging Markets for the BM40 Segments

The study project was managed by a joint industry taskforce consisting of representatives from MTA, LIAM and BNM, and the appointed consultant for the study was Milliman.

The presentation of the final report is conducted in phases:

• Phase 1 – Task Force

Phase 1 was held on 10 May 2022 through online platform. The purpose is to present and obtain concensus on the draft report.

• Phase 2 – Townhall

Phase 2 was held on 12 May 2022 through online platform. The purpose is to present the results of the final report and pertinent points of the same to a wider audience.

• Phase 3 – Workshop

Phase 3 was held on 17 May 2022 at Sheraton Hotel. The purpose is to discuss the product development process for lower-income segments and distribution models for the same, through applying the results of the market research study.

• Phase 4 – One-on-One Sessions

Phase 4 was held on 24 May 2022 until 26 May 2022 at MTA Boardroom. The purpose is to advise and recommend specific next steps that individual member companies can take to develop products/ideas to serve this segment.

Phase 4 of the initiative is a final report for the findings and the feedbacks from takaful operators has been completed.

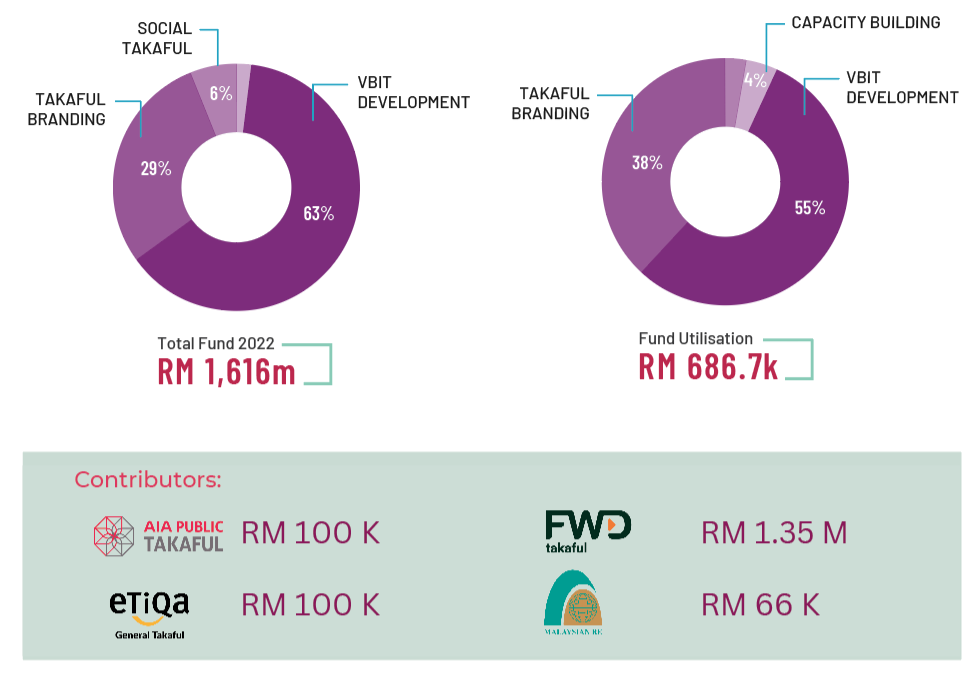

Fund4Cause

Fund4Cause is a key component of MTA’s Strategic Plan 22-23 (ISLAH23) and Financial Sector BluePrint 2026 (FSB 2026). The funds acquired under this initiative aim to provide the financial resources to the industry’s four development funds.

• VBIT Development Fund

• Social Takaful Fund

• Industry Capacity Building Fund

• Takaful Branding Fund

These four identified key areas are to be developed towards achieving the goals and aspirations of the industry and elevate it to the next level.

The funds will be used by MTA to support the various VBIT action plans and initiatives, Takaful branding activities, awareness campaigns, building of industry infrastructure, as well as studies and research to catalyse industry development.

Illustration 4: Total Fund 2022 of Fund4Cause and Fund Utilisation as at 31 December 2022

Illustration 5: Performance of Fund4Cause 2022

CONSUMER EDUCATION PROGRAMMES AND TAKAFUL AWARENESS

Medical and Health Takaful (MHIT) Awareness Campaign: #AmbilTahuBarulahTahu

From 2021 to 2022, the Takaful industry embarked a hashtag campaign on social media called #AmbilTahuBarulahTahu. The campaign was aimed to raise awareness among Malaysians on the importance of awareness among Malaysians on the importance of MHIT, so they could better understand the factors that could lead to changes in Takaful contribution.

The educational infographics were produced in three languages: Bahasa Malaysia, English and Mandarin which featured general information on Medical Inflation, Pooling System, Guarantee Letter and MHIT Claims. The contest was conducted to generate more view for the video. The video was supported with the educational infographics, posting by Key Opinion Leader (KOL), Dr Malar Santhi Satherasegapan followed by testimonial videos and also educational articles “Siakap Keli”, Lee Sharing and BURO 24/7.

On Dr Malar’s sharing, she encouraged her followers to be more proactive in finding out about their medical policy and how to maintain its sustainability. The videos also gained:

• Over 7.2 million views

• Reached about five million viewers

• A total of 180 winners were chosen throughout eight-week campaign

‘Us’ Road Safety Campaign

Persatuan Insurans Am Malaysia (PIAM) and MTA launched the ‘Us’ Road Safety Campaign with the slogan “Safety starts with ‘S’ but begins with ‘U’ on 21st April 2022. The aim was to create awareness, change mindset and inculcate safe driving and riding habits while educating the public on the high rate of accidents, its main causes and the impact on them, the economy and the Nation as a whole. The initial six-week Campaign period was extended to seven-weeks.

In addition to the agreed deliverables, a virtual forum was successfully organised in conjunction with the Campaign by students from the Media & Communication School of Taylor’s University in collaboration with PDRM and MIROS on 10th June 2022.

As part of the deliverables, a Contest was successfully held throughout the month of May 2022 with strong response especially from among the youth. It provided an avenue for Malaysians to share their views and provide tips on road safety, but more importantly, played a more active role as influencers towards improving road safety since they had to share their posting on their respective social media accounts as part of the contest requirement. The campaign was done via Social Media platforms.

• Social Media Platforms Account Creation (FB, IG, TT, Telegram)

• Social Media Content (Posters, VoxPops, Videos, Reels) Contest

• Press Releases

• Radio – RTM Nasional FM, TRAXX FM, KL FM, SELANGOR FM, MUTIARA FM, PERAK FM, JOHOR FM, NASIONAL FM

• Print – Branded Column (Harian Metro)

• Print – Branded Column (New Straits Times)

• Digital Banners (20x)

• Broadcast Interview (Selamat Pagi Malaysia)

• Group Interview (Print – New Straits Times & Harian Metro)