Menu

Menu

06

Takaful Visibility Activities

Takaful Awareness and Financial Literacy Activities

The Open Day is a platform organised by Malaysia’s Ministry of Finance (MOF) for the public to gain exposure and understanding on the country’s state of economy. The InvestSmart® team set up an exhibition booth at the event to engage with visitors through knowledge sharing sessions in relation to the capital market. Y.B. Dato’ Indera Mohd Shahar, Deputy Minister of Finance I visited the exhibition booth during this Open Day. The event was attended by 1,000 people from the local communities.

An Industry Talk about Perlindungan Tenang Voucher (PTV) was organised as part of the Open Day. The Takaful industry was represented by Encik Wan Ahmad Najib from FWD Takaful Berhad, who shared how Perlindungan Tenang is able to help the low- income segment access affordable and available protection.

Program Literasi Kewangan Digital was held on 27 June 2022 at Pulau Redang, Terengganu, a collaboration between MTA and BNM.

This programme aimed to gain insights on the effectiveness of the cashless initiative that has been implemented in Pulau Redang since 2018 as well as promote digital financial literacy. Several activities were planned, including an engagement session with the Majlis Pengurusan Komuniti Kampung, and a community talk targeting young adults and micro-entrepreneurs.

Encik Zaifizar Zainal Abidin from the Family Technical Department of MTA shared his knowledge on the benefit and value of Takaful protection with the audience.

MTA, in collaboration with the Faculty of Computer and Mathematical Sciences, Universiti Teknologi MARA (UiTM) Shah Alam, organised its first campus-based programme called Takaful In Campus. The event involved over 200 students and lecturers from the Faculty of Computer and Mathematical Sciences and the Faculty of Business Management, from the UiTM Shah Alam and UiTM Puncak Alam campuses.

The objectives of Takaful in Campus are to:

a) provide information on financial concepts that will help to educate the audience to manage their finances better; and

b) act as a platform for the students and industry to get together and exchange views, knowledge and any other information pertaining to Financial Literacy. It is a programme developed specifically for students to provide more in-depth information and knowledge about financial management.

The highlight of Takaful In Campus was a Shark Tank Pitch 5 which saw a total of 80 participants from 15 teams presenting their innovative ideas. This is part of an ongoing effort to accelerate innovation and adoption of technology within the Malaysian Takaful industry.

Takaful Masuk Kampung (TMK) Series: Karnival Rakyat 2022 is a programme that aims to provide exposure, guidance and education on the importance of financial planning to help individuals become more informed in personal finance including aspects of financial risk management, practical financial skills and building an emergency fund.

The series serves to expose the community to the importance of financial safety nets, such as Takaful protection, which is a very important instrument in financial management.

The objectives of the Series include; a) to increase the local community’s awareness of the importance and responsibility of financial planning; and b) to help members from the local community have proper understanding on the need to have Takaful protection as one of the financial instruments that can help them in emergency and needy situations. This understanding also includes the importance of Islamic Muamalat which avoids illegal and doubtful elements.

Five Takaful Operators – AIA PUBLIC Takaful Bhd., AmMetLife Takaful Berhad, Great Eastern Takaful Berhad, Hong Leong MSIG Takaful Berhad, and Prudential BSN Takaful Berhad – participated in this programme.

The Financial Education Network (FEN) launched the Financial Literacy Month 2022 (FLM2022) at Sasana Kijang, BNM, on 1 October 2022. FLM2022 is an annual flagship event held with the aim to enhance the awareness of consumers on key financial issues and improve financial literacy among Malaysians.

During the launch of FLM2022, BNM Deputy Governor Jessica Chew highlighted that financial education is critical to the safe and effective use of digital financial services. Supporting this important initiative to impart financial awareness and education, especially on digital financial literacy, MTA pledged its commitment to participate in FLM2022.

The month-long FLM2022 will feature engaging activities on strengthening the cyber hygiene of financial consumers and personal financial management talks. The nationwide roadshow will include the “Sembang dan Sebar” talks, which aim to highlight the latest financial scams and their modus operandi. This will promote the 3S (Spot, Stop and Share) concept to protect the rakyat from financial scams. In addition, the roadshow will drive e-payment awareness and the importance of insurance and Takaful, especially the Perlindungan Tenang initiative, which targets the underserved segments of the Malaysian population.

Shape Your Future #FitFinances was held on 27 to 28 October 2022. The 2-day workshop is a collaboration between MTA and Agensi Kaunseling dan Pengurusan Kredit (AKPK). 104 final-year students from nine vocational colleges participated in the workshop, which was designed to equip students of higher learning institutions with financial knowledge, skills and values to make wise financial decisions. The workshop covered the 7 dimensions of wellness. The key message was that achieving a balance between these dimensions of wellness (emotional, spiritual, physical, career/ intellectual, social-cultural, environmental and financial) will lead to financial well-being, resulting in a fuller, more satisfying life.

Aiming to increase financial awareness and education, especially financial literacy, this important initiative features engaging activities which will strengthen personal financial management. In addition, it also promotes awareness on the importance of insurance and Takaful. An Industry Talk on the Perlindungan Tenang initiative was conducted by Encik Noazril Aizat from Hong Leong MSIG Takaful. The talk encouraged students to optimise the various aspects of their physical, career, and intellectual health.

The first among the series of Takaful Masuk Kampung: Karnival Orang Muda Sungai Siput was held on 29 October 2022. This event was joined by 1,000 members of the local community from the Karai area. The objective of this series is to increase the local community’s awareness on the importance and responsibility of financial planning, and help them to better understand the need to have Takaful protection as one of the financial instruments that can help in emergency and needy situations. It also aims to build their understanding of Islamic Muamalat.

Five Takaful Operators – AIA PUBLIC Takaful Bhd., Etiqa Takaful Berhad, Great Eastern Takaful Berhad, Hong Leong MSIG Takaful Berhad, and Takaful Ikhlas Family Berhad – participated in this programme. The programme served to provide exposure, guidance and education on the importance of financial planning, helping individuals become more informed in aspects of personal finance including financial risk management, practical financial skills and building an emergency fund. It exposes the community to the importance of financial safety nets, such as takaful protection, as an important instrument in financial management.

The month of October 2022 was FEN’s Financial Literacy Month. MTA organised a career fair in collaboration with FINCO to raise awareness on financial literacy among the general public and secondary school students. This collaboration targeted upper secondary school students as the key audience for the Career Insight: Career Fair.

The collaboration allowed MTA to add value to the planned activities while, at the same time, leverage on FINCO’s work which represents the wider financial industry. The career fairs, which were held in three locations across Malaysia, helped upper secondary school students learn about financial management, and gave them insights on the importance of having Takaful protection in an individual’s life.

This event held at UniKL MSI, Kulim on 20 October 2022 aimed to raise awareness of financial literacy for the general public and upper secondary school students among UniKL and upper secondary school students in Kulim district, Kedah.

An Aspire Financial Literacy Workshop was held at SMK Elopura (pls specify date). The workshop was attended by 100 students from SMK Elopura, Sandakan. The students were taught about the importance of financial management and how to spend their money wisely.

A Career Fair was held at SMK Ketereh, Kelantan on 31 October 2022, which saw the participation of 200 students from the Ketereh district. The objective of this event is to raise awareness of financial literacy among the general public, primary and secondary school students.

Webinar Series

The massive floods in 2022 brought severe damage and widespread devastation in several states in Malaysia causing a huge financial strain on the flood victims, who were forced to fork out large sums of money to repair damaged homes and vehicles, and in some cases, replace assets that were beyond repair.

In light of these flood disasters, MTA, PIAM and Financial Education Network (FEN) collaborated to organise a webinar on the Importance of Flood Insurance/Takaful to raise awareness on the availability and affordability of flood insurance coverage, and how it can help to protect against financial loss due to damage to vehicles, property and businesses arising from flood. MTA CEO, Encik Mohd Radzuan Mohamed represented MTA as the moderator of this webinar.

This webinar is a sharing on the Fun(d) for Life Programme by FWD Takaful which aims to shape a financially-smart generation. Fun(d) for Life programme offers various activities, including access to an interactive online portal, financial literacy camps and design sprint-like events. The various activities take place across Malaysia throughout the year, either in person or virtually. Since its launch in 2019, the programme has reached more than 5,000 students across Malaysia. The webinar was conducted by Encik Wan Ahmad Najib from FWD Takaful and Ms. Alina from Arus Academy, attended by 791 participants who joined through the Zoom and MTA Facebook Live platforms.

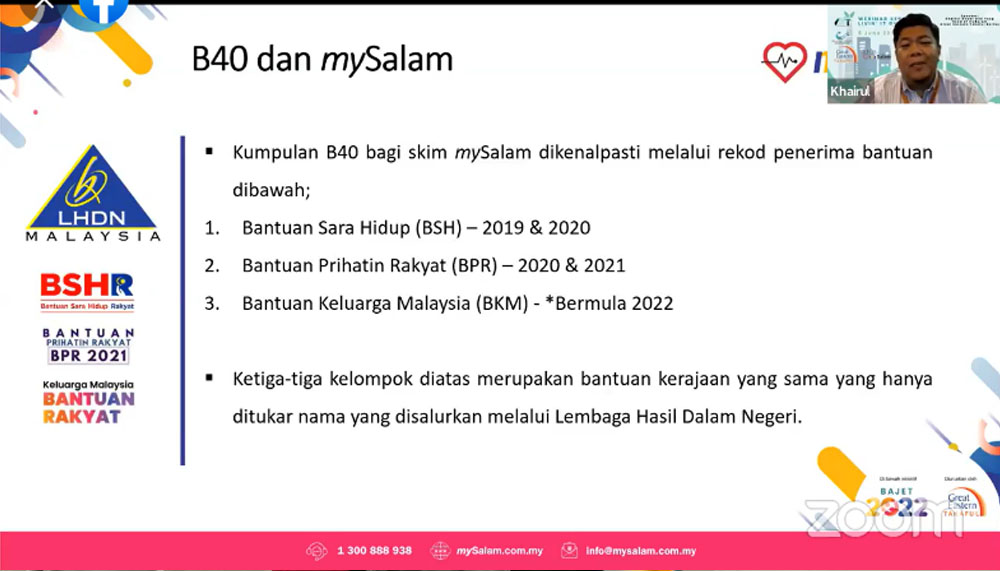

This webinar is a sharing on the mySalam scheme, a national health protection scheme based on the Shariah principles that aim to provide 8 million members with free Takaful protection.

mySalam is a free Takaful assistance scheme by the Government which provides Takaful protection for eligible individuals. Encik Khairul Che Yeop represented Great Eastern Takaful Berhad in the webinar, sharing the objectives and details of the mySalam scheme with over 300 participants who joined through the Zoom and MTA Facebook Live platforms.

In this webinar, Ms Azlin Mohamad and Encik Hilmi Deraman from PruBSN Takaful shared the details of PruBSN’s Microtakaful Jariyah initiative, which is offered via PruBSN Prihatin. The Microtakaful Jariyah initiative, which promotes wealth distribution among members of the community, aims at reaching out to low income-households to provide them with accessible Takaful products. It is the first offering of its kind in Malaysia that provides a full year basic life protection coverage of RM10,000 for breadwinners in the bottom 40% income group (B40) at no cost to them. The session was moderated by Encik Suffian Ab Rahman from MTA and attended by 521 attendees.

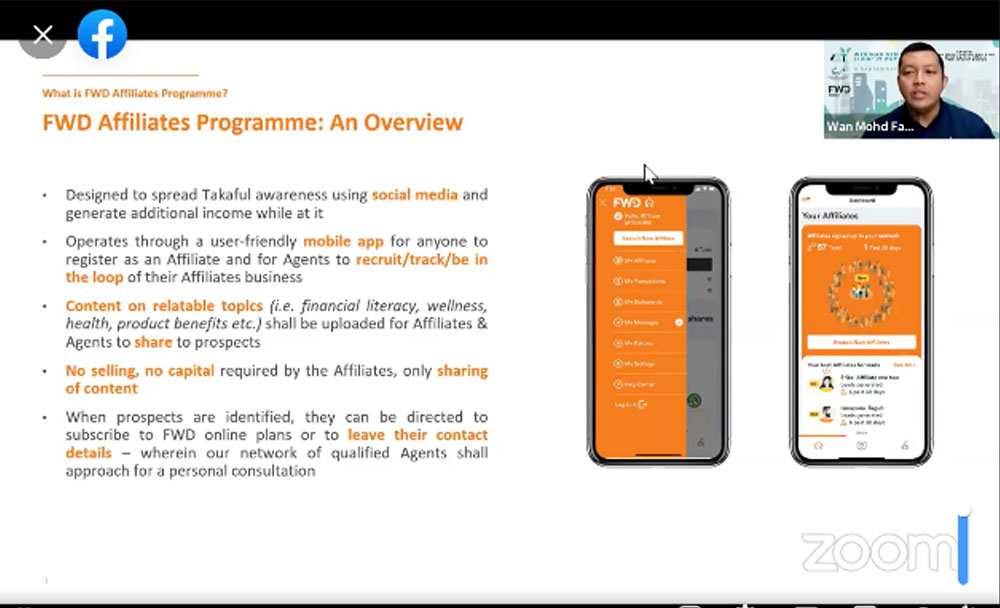

A webinar sharing on the FWD Affiliates Programme provided an enlightening overview on how new revenue can be generated simply by sharing insightful FWD Takaful and personal financial planning articles to your network via social media. The sharing, delivered by Encik Wan Ahmad Fadhlan and Mr Marcus Kim was attended by 430 viewers on Zoom and MTA Facebook Live platforms.

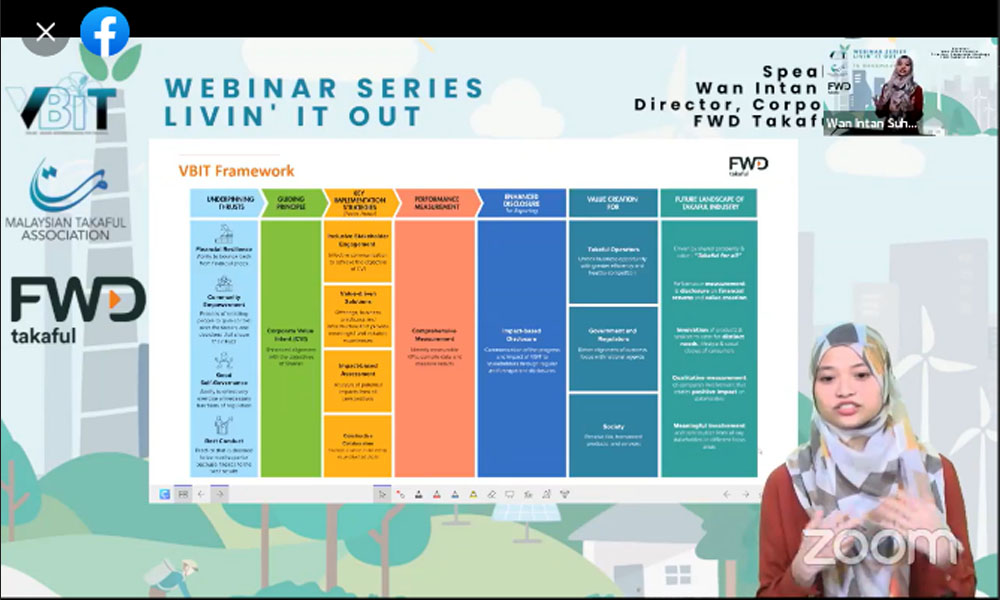

A sharing by Ms Wan Intan Suhaila on an interesting game called Komuniti Kita was organised to provide an insightful look at how financial literacy can be delivered in a fun and engaging manner. Players were able to experience how Takaful contributes to and benefits all layers of society. The hope is that Komuniti Kita, and similar games, will be able to make creating awareness and education on financial management more engaging and easy to understand for everyone. Come and enjoy the Takaful experience!

In conjunction with MTA Agency Month in August 2022 until December 2022 MTA organised Takaful Hi5 (THi5) Webinar Series – Takaful Leaders Edition. The THi5 Takaful Leaders Series provides an opportunity for the industry’s Top Achievers to share valuable tips and qualities that have been instrumental in making them successful agents, while simultaneously creating awareness of Takaful among the general public.

Following the success of the Takaful Star Awards 2022, and in recognition of the Awards recipient, MTA organised the THi5 Webinar Series – Winners Edition. THi5 Winners Series give an opportunity to award recipients to share their motivations, experiences and contributions towards achieving high performance and recognition in the Takaful Industry.

Pursuant to the release of BNM’s Discussion Paper (DP) on 2024 Climate Risk Stress Testing Exercise, MTA organised a Climate Change Webinar to further discuss issues related to the DP. The session was moderated by MTA CEO, Encik Mohd Radzuan Mohamed, with panellists from among the Takaful industry experts.

MTA and Persatuan Insurans Am Malaysia (PIAM) developed a National Campaign on the Reduction of Motor Accidents in Malaysia in 2022. The campaign sought to raise public awareness on the high rate of vehicle accidents and fatalities in the country, and its negative impact on the well-being of its citizens and the national economy. This campaign which ran for a duration of 3 Months was called the “Us” Road Safety Campaign. The slogan of the campaign was “Safety starts with ‘S’ but begins with ‘U’” and aimed at shifting the mindset of motorists and inculcating safe riding and driving habits.

A strategic cooperation between MTA and Lembaga Zakat Selangor (LZS) was sealed, that will provide the opportunity for the Asnaf community registered LZS (i.e., over 63 thousand heads of poor families who are Muslim converts) to obtain social protection through a redemption of RM75.00 under the Perlindungan Tenang Voucher (PTV) programme.

The RM75 PTV program is a Malaysian government initiative in the 2022 National Budget. As at 6 March 6 2022, a total of 729,173 vouchers worth RM 53 million have been redeemed by eligible Malaysian Family Assistance (BKM) recipients. The PTV RM75 initiative is a Malaysian Government collaboration with the takaful and insurance industry which aimed to extend social protection to the lower income groups.

MTA signed a Memorandum of Understanding (MOU) with the Fintech Association of Malaysia (FAOM) on 24 August 2022 to spur the adoption of financial technology (Fintech) and encourage digital innovation and the use of Fintech among Takaful players in Malaysia. The signing of the MOU is a strategic initiative by MTA that supports FSB’s Strategic Thrust 3: Advance Digitalisation of the Financial Sector.

MTA CEO, Mohd Radzuan Mohamed said that the cooperation between the two associations will pave the way for Malaysian Takaful operators to explore the potentials and opportunities of Fintech as we individually and collectively aim to achieve greater productivity, efficiency and effectiveness in our business operations, stakeholder communications (including agency networks) as well as customer interactions. He added that more importantly, the cooperation allows us to explore avenues towards the implementation of initiatives identified under the Value Based Intermediation for Takaful (VBIT) Roadmap (launched in July 2022) and relevant initiatives under the national FSB 2022-2026.

Innovation and digitalisation in the Takaful sector is expected to benefit the industry, helping it step up its game, especially in making Takaful more accessible to the Malaysian public, thereby contributing to greater financial inclusion and social protection among Malaysians.

MyDuitStory (MDS) is a short video competition is a financial education initiative by Financial Education Network (FEN). The competition aims to raise awareness on the importance of personal financial management in our lives among youngsters. MTA in collaboration with FEN is creating awareness regarding financial literacy to the public.

MTA showed its strong commitment to shared prosperity and value through its newly launched Value Based Intermediation for Takaful (VBIT) Roadmap which provides guidance for the industry, Takaful operators, and Retakaful operators on how to implement the VBIT Framework by outlining key initiatives based on the five VBIT Underpinning Thrusts.

The Roadmap, launched in October 2022, during the Global Islamic Finance Forum (GIFF) 2022 provides a step-by-step guide that clearly explains the desired outcome of VBIT, gives motivation to achieve the desired outcome, recommends initiatives that can be implemented and their key performance indicators, and provides a detailed timeline to complete the initiatives. The Roadmap also identifies the challenges in implementing the proposed initiatives and the mitigation plans to overcome such challenges.

MTA Chairman, Elmie Aman Najas said that the VBIT Roadmap is a dynamic document. He noted that it is still exploratory in nature and is intended to be responsive to the industry’s changing dynamics. It shall ultimately contribute towards building a deeper understanding of VBIT for the industry. The VBIT Roadmap is seen as an important contribution which reflects the proactiveness and combined thinking of the Takaful industry’s leaders on how they can collectively strive to achieve the industry’s aspiration to deliver Takaful for All.

Courtesy Visit

On 17 October 2022, MTA received a visit from PERWATAM’s team members. The visit aimed to seek opportunities for collaboration between MTA and PERWATAM.

On 18 October 2022, MTA received a visit from UiTM’s Faculty of Business Management, Puncak Alam Campus. The purpose of the visit is to discuss further collaboration in research and consultancy with MTA.

On 19 October 2022, MTA welcomed guests from IRA Uganda, whose visit was aimed at learning about the Takaful industry and its developments from various parties in Malaysia. IRA is planning to license a Takaful operator in their country. MTA was chosen as one of the organisation during the study visit organised by the Islamic Development Bank – KL Centre of Excellence (IsDB KL CoE) under its Technical Cooperation Program (TCP) to assist Uganda in developing its Takaful sector. The delegates also visited BNM, INCEIF and IBFIM to get a better understanding on the Takaful eco-system.

On 7 December 2022, MTA received a visit from the Iranian Insurance Research Centre (IRC). The purpose of the visit is to discuss on mutual cooperation between MTA and IRC.

Students from Politeknik Shah Alam (POLISAS) visited Menara Great Eastern as part of a study visit to explore the importance of understanding basic concepts and skills in managing individual finances. They also had the opportunity to better understand wealth preservation using Takaful, which safeguards wealth against financial risks and threats, protects assets and physical property against unpredictable occurrences and potential loss. They were also exposed to the career opportunities offered by the Takaful industry.

On 23 May 2022, MTA organized MTA Subcommittee Raya Gathering At Majestic Hotel Kuala Lumpur. The Gathering Of Mta Subcommittee Members Was Held In Recognition Of Their Hard Work Towards Achieving Good Takaful Industry Performance. Almost 150 Subcommittee Members Attended This Appreciation Event.

MTA organised a Chilin’ Chat Session at Serai KLCC with the objective to update all member companies’ communications and marketing representatives on recent industry updates. A session included a special sharing by Professor Mohd Said Bani, President of the Malaysian Public Relations and Communication Association (PRCA).

MTA organised The Annual Takaful Star Awards (TSA) 2022 on 2 November 2022 at Malaysia International Trade And Exhibition Centre (MITEC). The TSA is the biggest Takaful industry event of the year that brings together members of the Takaful fraternity to celebrate the achievements of industry players and recognise the milestones and distinctions of the Malaysian Takaful Industry over the past year. MTA Chairman, Elmie Aman Najas acknowledged the efforts of all Takaful Operators towards enhancing customer experiences, and agents pursuit to consistently deliver high levels of excellence, tenacity, empowerment, as well as creative methods in serving clients. Various categories of awards were presented during the event. Congratulations to all winners!

The launching of MTA’s Fund4Cause and announcement on the Takaful industry’s performance for the year 2021 was held during an Iftar with the media on 25 April 2022.

The industry’s 2021 performance was shared by MTA Chairman, during which he also revealed MTA’s Strategic Plan 22-23 (ISLAH-23), and launched the newly established Fund4Cause initiative.

Fund4Cause intends to be a key enabler for the Takaful industry to implement the planned initiatives of ISLAH-23, VBIT Roadmap and FSB 2026. It serves to provide critical financial resources to the industry’s four development funds; VBIT Development Fund, Social Takaful Fund, Industry Capacity Building Fund and the Takaful Branding Fund.

MTA member companies demonstrated their support during the initial seed funding for Fund4Cause. Encik Elmie Aman Najas reiterated the industry’s commitment stating that as a group, the MTA member companies have identified and are embracing the areas which will serve to push the industry to the next level of performance. Ultimately, we want a burgeoning Takaful industry that will bring greater opportunities and potential returns to Takaful and Retakaful operators, agents, participants, and the industry as a whole.

MTA announced the launch of pioneering industry-driven research to develop a scorecard based on the Maqasid al-Shariah (objectives of Shariah) to elevate the performance of the Malaysian Takaful industry to a higher level. Anticipating the industry’s pain point to develop workable and measurable performance indicators to chart the progress and impact of its growth and development, MTA initiated a strategic collaboration with INCEIF University to develop a Maqasid al-Shariah Scorecard (MSS).

The joint effort between MTA and the ISRA Research Management Centre of INCEIF University will support the VBIT aspirations that accompany the potential growth of the Takaful industry in Malaysia. In this regard, the scorecard goes beyond measuring successful initiatives, rather will elevate the measures to identify the impact of such initiatives including how well the initiatives are carried out and to what extent they have helped vulnerable communities. The scorecard aims to ensure that the initiatives should, as much as possible, bring the benefits of Maqasid al-Shariah to the communities they serve.

The CEO Strategic Retreat was held at DoubleTree by Hilton Putrajaya from 11 to 12 March 2022. The objectives of the retreat were to:

- Present updates on MTA reforms and the Association’s business plan for 2022-2023 (ISLAH-23)

- Discuss the FSB 2022-2026

- Discuss MTA’s Constitution Change proposal

The CEO Outing was initially proposed and agreed during the CEO Retreat in Putrajaya. The event was held at Kuang Kampung Retreat, Sungai Buloh on 21 April 2022. This objective of the outing was to foster a closer relationship and synergy between all CEOs of all member companies.

The workshop led by SK Chamber was help on 28 September 2022. The objective of the workshop was to gain a better understanding on the Anti-Competition Act and its implications on day-to-day operational activities.

The muzakarah event was held at the AICB Building on 12 December 2022. The muzakarah, attended by General Takaful CEOs company and aimed to develop a General Takaful Operators strategic Plan for 2023 to set a framework and roadmap to capture the general takaful/insurance business.

Community Engagement Programme

Etiqa Takaful Berhad and MTA jointly organised an Iftar event during Ramadhan as part of Community Social Responsibility (CSR) engagement. The programme was held at Penjara Sungai Buloh, Selangor. The program is hoped to give a different experience and opportunity for the MTA and Etiqa Takaful Berhad to engage with inmates and bring them joy during Ramadhan. About 500 prison inmates and 50 prison officers participated in the program.

RTM Selamat Pagi Malaysia invited MTA to participate in an interview on Krisis Bencana Alam (Banjir) on 11 Mac 2022. Encik Sabri Ramli, CEO of Syarikat Takaful Am Berhad, represented MTA in the interview. He explained that Takaful coverage and vehicle insurance provide basic coverage for incidents such as accidents, fire, and theft. Natural disaster protection is an additional protection or “special peril” which need to be purchased on top of the Takaful protection and basic insurance. He also shared that many customers do not take protection against natural disasters, including floods and landslides for vehicles.

This interview discussed ‘Us’ Road Safety Campaign which aimed to raise awareness about the high accident rates and causes of accidents, as well as their impact on the economy and the country. The campaign also emphasised the need to change the community mindset and practices towards more prudent driving, especially among car drivers, motorcyclists, gig economy workers, and commercial drivers.

MTA was represented by Encik Shamsul Azman, CEO of Zurich General Takaful. He also discussed about the ‘Us’ brand as an icon of road safety awareness in Malaysia.

The interview with Encik Mohd Radzuan Mohamed, CEO of MTA CEO was centred on the assistance offered by Takaful operators for Takaful participants involved in the 2022 floods. The assistance included Takaful operators simplifying the claims process, giving relief for several additional months for the payment of contributions, restructuring of contribution payment mode, extending of grace period up to 30 days for payment of contributions, cost exemption for reprinting Takaful certificates and free car towing/towing service. MTA hoped that the discussions served to show the value proposition of the Takaful industry, and build greater confidence in the industry among the public and customers.